Prepare for Hail Season: Choose the Right Insurance Coverage

Don’t find out the hard way that you have the wrong insurance coverage after a hailstorm

As a top roofing company in metro Denver, we regularly ask homeowners about their insurance coverage.

We have seen several homeowners who intend to file a hail damage insurance claim, only to learn they have insurance coverage that will leave them paying $10,000 or more to replace their roof. The sole reason is they were simply unaware of the type of insurance coverage policies they had.

Hail season in Colorado begins in May. Spring is a great time to review your insurance policy with your insurance company to ensure you have the right coverage for you.

REQUEST FREE ROOF INSPECTIONTwo Types of Homeowners Insurance Policies

Don’t Get Caught by Surprise

When selecting a homeowners insurance policy, there are two types of policies – Replacement Cost Value (RCV) and Actual Cash Value (ACV).

We recommend homeowners research their insurance policy and speak with their agent to ensure the right coverage that would ideally cover the full replacement value on any claim.

What Is Replacement Cost Value?

Replacement Cost Value (RCV) is the amount your insurance company will pay to replace any property damage and personal property from storm damage like a windstorm or hailstorm. For a hail claim, liability coverage may include your roof, siding, windows, contents, and more. The RCV is the current cost to replace the damaged product.

Certain property types will not qualify for an RCV policy, or you may need to ask your insurer to include this type of coverage. Examples we frequently hear of are rental properties, trailers, or mobile homes.

To minimize your out-of-pocket cost following an insurance claim, it’s best to choose replacement cost coverage.

An Actual Cash Value (ACV) policy, by contrast, will pay you only the actual cash value after depreciation.

What Is Actual Cash Value?

The Actual Cash Value coverage examines the value of your property just before the covered incident, like a hailstorm. For example, a 15-year old roof with a 30-year lifespan has used 50% of its life expectancy. This lost value is known as depreciation. An ACV policy will not pay to cover the 50% used or depreciated cost over time. Beyond age, insurance companies also consider the condition of an item when calculating the ACV.

It is essential to know your policy coverage to avoid any financial surprises.

What Can You Do?

We recommend homeowners meet with their insurance company (and local agent if you have one) once each year to review their policy.

You can select a policy with a full current market replacement value with either a higher deductible or premium. Or you can choose a policy that pays out less, factoring for age and condition, but with a lower deductible or premium. For example, damage to a 15-year old roof with a 30-year shingle will result in only a 50% payment by your insurance company (before deductible) and leave you with 50% of the replacement cost to be covered by you.

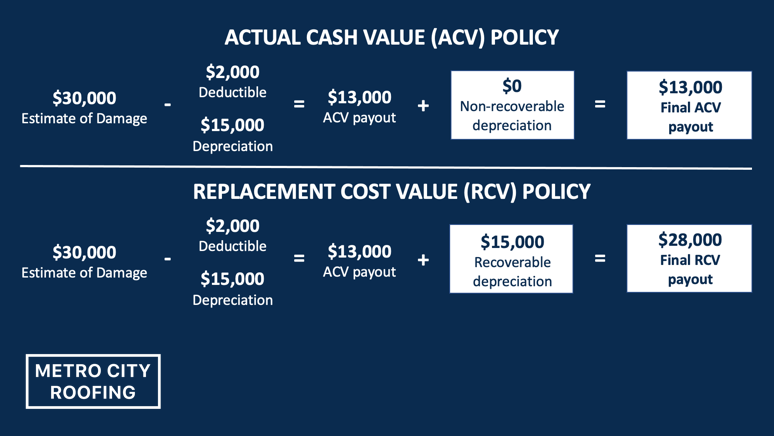

Let’s review an example in detail.

There is an estimated $30,000 damage to your roof. No matter the policy, there is a $2,000 deductible and $15,000 depreciation, and a $13,000 ACV payout from the insurance company. Now here’s where the RCV differs. The ACV policy has no recoverable depreciation, so $13,000 is all you will receive from your insurance company towards your $30,000 roof replacement estimate. In the RCV policy, you will recover the $15,000 depreciation, bringing the total insurance payments to $28,000. You are still responsible for your deductible, but insurance pays the balance of the amount required to replace your roof.

Don’t Just Take Our Word

Here’s What the Nation’s Top Insurance Companies Have to Say

If you visit your home insurance company’s website, you will find additional information on the different types of policies they offer. For example, many big insurance companies, such as Allstate, American Family, Amica, and State Farm, have clauses on their websites that describe Actual Cash Value policies and note that wear and tear are factored into the depreciation value of your roof.

Some insurance companies, like USAA, do not offer an ACV policy and only cover full replacement value. These are important details to note on your insurance policy.

During your review with your insurance company, you should also check how long you have to file a claim after a hailstorm. Some insurance companies have different timelines.

You will find links to several major insurance companies replacement value pages below:

Why Choose Metro City Roofing?

Metro City Roofing is a Colorado roofing company, headquartered in Denver, CO. We specialize in hassle-free professional roofing and will treat your home like our own.

Metro City Roofing is a roofing and building contractor that has worked diligently to earn essential credentials, certifications, licenses with national and local governments and local building departments, and a roofer you can trust.

We deliver the best professional roofing services across the entire Denver metro area. We are proud of the excellent reputation we've earned, with outstanding customer satisfaction, one roof, and one customer at a time.

REQUEST FREE ROOF INSPECTION