Insurance Claim Appraisal: What to Do with Your Insurance Denied Roof Claim?

Homeowners may choose to file an insurance claim to help cover the costs of costly roof repairs or a roof replacement after a damaging hailstorm or windstorm. Homeowners may experience much stress with the uncertainty of the insurance claims process and possible damages to their homes.

Finding a reputable roofing company that provides professional roof inspections and has experience with hail damage insurance claims experience can alleviate much of the stress. Homeowners typically trust the roofer’s recommendation to file a claim. Some roofing companies detail their inspection results with photos and video to show homeowners any damages found, which can assure the homeowner of actual roof damage.

With a filed claim, most homeowners expect that their insurance company will find similar damages and cover the roof repair or replacement costs. Unfortunately, insurance companies make grandiose promises with advertising and marketing like:

- “You’re in Good Hands with Allstate.”

- “Like a good neighbor, State Farm is there.”

- “Nationwide is on your side.”

At times, insurance may not agree to cover all damages, citing a lack of sufficient damage to cover the roof repair costs, saying the damage is anything but for hail, or that the hail damage is old and cannot be covered by the recent storm date. That’s what makes a roof insurance claim denied so confusing.

Stress levels can soar when a homeowner’s claim is denied. As of early 2022, the average cost to replace a 2,000 square foot roof is $12,000 to $15,000 but can more than double in price based on the roofing material, the roof pitch, accessibility, and actual size of the roof. For many homeowners, funding this cost yourself is simply not financially possible.

What can you do with an insurance denied roof claim? The good news is that the insurance companies do not have the last word. If your roof insurance claim is denied, you may go the route of insurance claim appraisal. Homeowners can elect this policy option whether the claim is wholly or partially denied, meaning that the covered amount is undervalued to cover all roof replacement costs.

The insurance claim experts at Metro City Roofing have you covered. We do not walk away from customers simply because the insurance company says no. We differ from other roofing companies as we advocate for our customers throughout the claims process until we successfully settle your hail damage roof claim.

Your claim denial is not the final word. Continue reading to learn more details about the insurance claims denial and appraisal process.

Table of Contents

- What is “Appraisal” When it Comes to Roofing Insurance Claims?

- Understanding How Does the Insurance Appraisal Process Works

- Insurance Company Denied Your Roof Claim: Now What?

- Find Out the Reasons Why Your Roof Insurance Claim Was Denied

- Appealing a Homeowners Insurance Claim Denial

- How to Dispute a Roof Damage Insurance Claim Denial?

- How Your Local Roofing Company Can Help with Insurance Denied Hail Damage Roof Claim?

- How to Avoid Getting Your Roof Insurance Claim Denied?

- Get Your Roof Damage Insurance Claim Approved with a Knowledgeable Roofing Contractor

What is “Appraisal” When it Comes to Roof Insurance Claims?

Appraisal is a popular term when buying a home and working to obtain a mortgage, where an inspector will determine the home’s fair market value to ensure sufficient equity to qualify for the loan. Yet Insurance claim appraisal is not a term with which many homeowners or policyholders are familiar, but it is included as standard policy language and your right.

The appraisal process is a remedy within home insurance policies to resolve insurance disputes.

It is written as an optional method to dispute resolution, meaning that if either party, the insured or insurer, demands it, it becomes mandatory. Any determined result is binding, and it is best to hire a professional appraiser to represent you to increase your probability of a successful outcome. Most long-standing roofing companies have likely needed to go this route at some time, especially when the roofer believes that the claim has merit and the homeowner is simply the victim of the unfair insurance claims process.

It is critical for your roof insurance claim to have a trusted roofing contractor and one with experience in the insurance claims process and appraisals. Otherwise, your claim may expire once you receive the insurance company’s initial denial or limited coverage.

Are you looking for the best Denver roofing company?

Metro City Roofing is the #1 roofing contractor recommended by local insurance agents across the Denver metro area.

Request free roof inspectionUnderstanding How Does the Insurance Appraisal Process Works

The appraisal process begins after an insurance company’s homeowners insurance denied roof claim estimate fails to cover the expected damages. The insured (also referred to as the homeowner) invokes their right and hires an independent appraiser to force the insurance company’s position.

So how does the insurance appraisal process work? The appraisal process begins by signing and submitting an Appraisal Demand Letter (ADL) to the insurance company. Once receiving the Appraisal Demand Letter, the insurance company has a finite timeline to review the request and select its appraiser under the insurance policy terms. This appraiser is to be independent – and not simply an extension of the insurance company’s previous response. Once the appraisers are selected, they must choose a neutral, third-party umpire in case both appraisers cannot reach an aligned resolution. The two appraisers and the umpire are known as the appraisal “panel.” From there, agreement by any two of the three appraisal panel members will finalize the extent of loss and set the financial coverage amounts.

The need for appraisal may be that the insurance company denied your claim entirely. Or it does not agree to pay for parts of the claim, like Contractor Overhead and Profit, which is an industry-standard term to fund hiring a single contractor to manage your entire claim when the claim includes multiple trades. An example of warranted Overhead and Profit would be when your claim consists of a new roof replacement, new gutters, skylights, solar, windows, siding, screens, or any combination.

Further, your home may be positioned with limited access for roof materials to be loaded directly onto your roof. There is no nearby driveway to allow discarded materials to be tossed from the roof. On some occasions, a home may have a driveway with pavers or heated pavers, and the roof supply distributor and the contractor cannot use the driveway at all. When this happens, the insured has the right to invoke the insurance appraisal process to cover all needed work scope at fair market value fairly.

The appraisal provision in your homeowners insurance policy allows the insured (the policyholder) to hire an independent to represent them. Both appraisers agree to meet, each armed with the previous positions, to inspect themselves and work towards resolution in the scope of damages and cost. The Amount of Loss is the total dollar amount needed to return the damaged property like your roof and any other damaged property back to its pre-storm or pre-event condition, either by repair or replacement.

It is important to note that the appraisal process is time-consuming. We do not recommend invoking this right until after your insurance carrier has clarified its unwillingness to further review and work towards a fair settlement.

At Metro City Roofing, we work with homeowners to demand appraisal less than 10% of the time. For half of our cases, we may simply be focused scope beyond the roof, best representing our clients on a case-by-case basis.

We see several insurance companies moving away from the industry-standard estimating software Xactimate to an alternate Symbility. Symbility has become attractive for insurance companies for paying less than fair market value.

We are experiencing that Symbility prices its claims approximately 30% less than Xactimate.

When remembering that insurance companies are for-profit businesses, it is no surprise that they will seek methods to save money. With Symbility, the insurance company may still approve a claim with the correct scope, but homeowners and contractors cannot align on pricing. Recently, we had a customer with an approved roof replacement and solar claim where two previous roofing contractors walked away from completing the work solely on price. Metro City Roofing successfully negotiated with the insurance company and completed the job at fair market value.

Insurance companies like Shelter Insurance that use Symbility shared that they understand the under-market pricing and are prepared to go to appraisal when pressed. They know they will lose most of the time but win some of the time.

Insurance Company Denied Your Roof Claim: Now What?

It is important to note that not all insurance companies and adjusters are bad. Most adjusters are good people trying to be fair and do right by the policyholders. But what can you do when your insurance company won’t pay?

Unfortunately, insurance adjusters may be directed to specific outcomes. Insurance adjusters may receive direction from their managers to affect results. In 2021, our company was involved with a State Farm denied roof claim where the insurance adjuster was on the roof for less than 60 seconds before advising that the damage to the roof shingles was not hail damage. When questioned, he said he had no idea what the damage was, only that it indeed was not hail. It was simply impossible to complete a thorough inspection in that amount of time. The adjuster simply never attempted to provide an unbiased assessment in less than one minute.

That adjuster then included 19 roof vents for hail damage, which opened the door for a reinspection. Still, the following State Farm adjuster denied the roof again but marked hail damage to one shingle and included hail damage to the gutters, downspouts, window screens, and garage doors. Since nearly half the neighborhood had their roofs replaced, including ten by our company Metro City Roofing, we recommended demanding an appraisal. The homeowner agreed, signed an Appraisal Demand Letter, and submitted it to State Farm. The two appraisers met and decided that the roof had extensive hail damage and was approved for the entire roof replacement. We needed some patience and trust in the process.

Similarly, in 2016, we had an Allstate denied roof claim where we had documented extensive hail damage on a roof and had already replaced three neighbors’ roofs on the same block. One of our company representatives met the insurance adjuster. Upon arrival, the adjuster stated no hail damage on that roof. Stunned, we asked if he had been on the roof, to which he replied no – but restated there was no hail damage on the roof. He eventually agreed to get onto the roof but quickly was off the roof within 45 seconds, marking no damage. He was clearly instructed to deny all claims.

Thus, the insurance claims process is not always straightforward. Once you file the insurance claim, there may be only one person involved from the insurance company, assuming the roof claim is approved. Or there may be several people involved in the example above.

After the insurance company’s inspection, the policyholder will receive a summary of damages and the decision. If the claim is approved, you will receive an initial estimate listing the overview of damages. If the claim is denied, the insurance company will have you believe there is nothing else you can do. Of course, insurers rarely have the final say for your insurance company denying a roof claim. There may be underlying reasons beyond damage to your specific roof that determine the outcome.

Homeowners contact us as a professional roofing contractor and share comments like, “Allstate denied my roof claim. Is there anything I can do?” There may be legitimate reasons that a roof claim was denied, like minimal or no hail damage or the homeowner filed the claim past the filing limit. That doesn’t mean a homeowner should simply accept the insurance adjuster’s position and move on. We offer free roof inspections and are happy to provide another opinion.

In some cases, the insurer’s decision is baseless or uninformed. The great news is that even if the insurers deny your roof insurance claim, all hope is not lost.

Having a trusted roofer with the knowledge and experience on what to do next and how to appeal a denied insurance claim is critical to getting your roof claim approved for complete roof replacement.

Find Out the Reasons Why Your Roof Insurance Claim Was Denied

When an adjuster denies your roof insurance claim, it may be hard to comprehend. At Metro City Roofing, we are a professional roofing contractor where every sales and project team member is a licensed adjuster, completing the same industry-standard testing as the insurance company adjusters. It’s difficult for us to hear an adjuster inform a homeowner that the roof has damage. They do not know what caused it, but it is not hail. Adjusters defend this weak position by stating they don’t need to know what caused the roof damage, only that they know what didn’t cause the damage.

There may be additional reasons your roof insurance claim is denied. For example, you may not have owned the property at the date of loss for the hailstorm. The real estate market is hot these days, with some buyers waiving the right to a home inspection. When this happens, if the homeowner learns that roof damage exists, she cannot get their roof claim approved. It is a policy condition that the policyholder must own the home at the date of the storm. However, if you change insurance companies, you can still file a claim with your previous insurance company with a successful result.

Insurance companies must deny claims when a policyholder has a roof exclusion policy. At Metro City Roofing, we inspected a roof in Fort Collins, Colorado, with extensive hail damage and deterioration. The damage was so bad that the roof’s deck was visible in spots, which explained the more than five interior leaks. We recommended a hail claim and learned that the homeowner opted for an inexpensive policy and selected a roof exclusion. That meant the homeowner had to pay 100% of the roof replacement costs – and insurance had no responsibility.

There are times when the insurance company doesn’t technically deny the claim, but the homeowner receives no payment to cover damages. It might be that the roof damage was minimal, and the repair or replacement costs do not meet the homeowner’s insurance deductible. It is essential to know your insurance deductible for hail or wind claims and ensure that you have the financial means to cover your deductible in an extreme storm.

It’s also important to remember that a homeowner’s insurance policy covers natural disasters like hail or wind but will not cover basic home or roof maintenance. So, if the damage is old, outside the coverage period where a homeowner can file a claim, or if the damage is considered normal wear and tear, insurance will not cover the repairs or damage.

Insurance companies typically allow only one year to file a claim, so we strongly recommend having your roof inspected immediately following a storm and filing a claim timely if you learn that your roof has damage.

Below are the most common reasons for denying roof claims:

Roof Insurance Claim Denied Due to Previous Roof Damage

If your insurance company paid you for previous roof damage and you’ve not completed the work, your insurance company will deny your claim. However, if additional damages were not included in a previous claim, your insurance company will cover those. Unfortunately, if the insurance estimate previously included the roof, most additional damage will be minor – and unlikely enough to cover the insurance deductible.

Homeowners insurance policies set specific time limits that allow policyholders to file a hail or wind damage roof claim. The time limit is one year for most insurance companies, while State Farm allows two years. If one waits too long to file a claim, there is simply nothing an insurance company can do to approve your claim, regardless of damages. And home insurance for hail and wind is intended to cover a specific weather event within this timeframe. Thus, old damages are not covered by insurance but are considered maintenance issues.

PROOF POINT

In 2018, we had a Denver customer contact us concerned about hail damage to her roof. During our inspection, we validated her concerns and recommended filing a claim with her insurer USAA. One spring morning, one of our salespeople met with the adjuster, who advised that the homeowner had filed a claim in 2016, which already covered the house roof. We inspected the roof and documented new damage to the home’s garage and flat roof porch, not included in the previous claim.

The homeowner received proceeds to cover this further damage, less her deductible, but declined to do the work since she would have had to cover the previous amount paid with her earlier claim – and the cost of two deductibles.

Roof Insurance Claim Denied Due to Determined Partial Damage

For an insurance claim to cover a complete roof replacement, the assigned insurance adjuster must identify and document enough damages to the entire roof, and more than a partial repair would fix. Each insurance company sets its criterion for determining the required damages for roof replacement vs. roof repairs. But the insurance adjuster is the initial decision-maker to decide your claim’s fate.

It can be very frustrating to see many homes in your neighborhood getting new roofs. At the same time, your claim was denied or covered for partial damage, like paying to replace the front elevation and several exhaust vents but not the entire roof. In some cases, the adjuster simply doesn’t see any further damages, but he may be instructed to pay for roof repairs vs. a roof replacement in other cases. The good news for homeowners is that partial damage is one of the most likely denials to be overturned.

PROOF POINT

At Metro City Roofing, we had a State Farm claim in 2015 where an insurance adjuster agreed to cover 75% of the roof (e.g., front, right, rear) but not the last 25% that would have allowed the entire roof replacement covered by insurance. We disputed this adjuster’s position, and the insurance company sent out a different adjuster. This new adjuster agreed to cover everything.

Roof Insurance Claim Denied Due to Manufacturers Defect

Some asphalt shingle manufacturers have earned reputations for better quality than others. All manufacturers try to maintain quality control of their products, but some do better than others. Roofing materials, like asphalt shingles, are no different. Shingles with manufacturing defects will degrade earlier than their intended life expectancy. When an adjuster determines that your roof damage is not the result of hail but rather a manufacturing defect, they are not responsible for covering your replacement costs.

Further, all manufacturers have material warranties with the purchase of their products. The warranty coverage varies by manufacturer and actual warranty selected, such as choosing a more extended warranty. Some extended warranties cover materials only, some that coverage depreciates over time, while others cover materials and labor.

At Metro City Roofing, we install the best products from the industry’s top manufacturers. We will not install some brands due to their reputation, impacting our reputation as a leading Denver metro roofing contractor.

PROOF POINT

In 2019, a customer in Denver, Colorado, contacted us about hail damage to his roof following a recent hailstorm. One of our licensed roof inspectors confirmed damages and recommended filing an insurance claim.

The insurance adjuster denied the claim citing a manufacturing defect as the cause of roof damage. Based on the roof’s age, the manufacturer changed the length of its asphalt shingles in the early 2000s, which inhibited our ability to replace individual shingles without replacing the entire roof. We disputed the insurance inspection results, and the homeowner got a new roof.

Manufacturers have strict limits on what they will pay for repairs or replacements for defect issues. Unfortunately, the amount is often insufficient to complete all work without the homeowner paying additional costs.

PROOF POINT

In 2021, a customer in Colorado Springs contacted us to advise that someone knocked on his door and said he could get a new roof covered by a manufacturing defect. The homeowner didn’t trust the door-to-door salesperson and contacted his insurance agent, who recommended Metro City Roofing. We did see minimal shingle damage during our roof inspection, but nothing to justify replacing the entire roof. Further, since the roof had solar panels, the homeowner would have had to pay to detach and later reinstall it, putting him in a position to pay nearly $10,000 of his $20,000 roof replacement. He didn’t do the work.

Roof Insurance Claim Denied Due to Filling it Too Late

Insurance companies establish policy language that dictates the time a policyholder can file a claim from a hailstorm or windstorm.

Wait too long, and your claim will be denied regardless of damages.

Most insurance companies limit policyholders to one year from the most recent storm damage, while State Farm allows two years for its policyholders. Other insurance carriers set no limit on the filing date, but the catch is that these policies do not cover total replacement cost value but rather adjust for age and condition.

Thus, a roof with a 30-year shingle that is 15 years old will only qualify for 50% coverage before the deductible. We strongly recommend against lesser insurance policies that limit coverage. It’s best to speak with your insurance company for more details.

PROOF POINT

At Metro City Roofing, we routinely are contacted by homeowners in this situation. We provide a free roof inspection and document roof damage but recommend against filing a claim simply due to the date of loss being too far in the past. The homeowner can then choose to make minor repairs now, pay for the entire roof replacement without insurance, or choose to do nothing and pray for a new hailstorm.

Further, do not file a claim and agree to have your roof inspected by the insurance company if you cannot get it approved. The adjuster will document all damages with photos for the insurance company’s records. When a new storm allows you to file a claim, they will look carefully to distinguish what damages existed previously vs. the recent storm.

Roof Insurance Claim Denied Due to Insurance Adjuster Interpretation

Depending on the storm damage, the assigned adjuster to inspect your roof may be limited in his knowledge and experience. He may be a new adjuster, just completing the required training and lacking previous roofing experience. And to err is human. Even an experienced, well-intentioned adjuster can miss indicators that could result in your claim being approved.

PROOF POINT

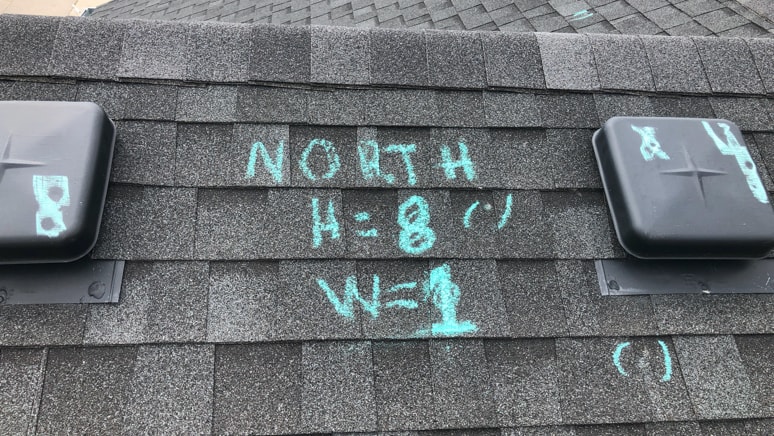

At Metro City Roofing, we strongly recommend to every customer that we attend the insurance company inspection for two reasons. One, we represent the homeowner, while the adjuster represents the insurance company. We advocate for our customers and want the adjuster to know we will push for the claim approval. Two, we are licensed adjusters who speak the same language and work together to get your claim approved while on the roof. Four eyes are better than two eyes to inspect for damage carefully.

It’s always best to explain why insurance should cover any damage before it is denied. Leaving your insurance inspection to chance dramatically reduces the odds of an approved claim.

Roof Insurance Claim Denied Due to Deductible Being Less than the Claim

With an approved insurance claim with replacement cost value coverage, the policyholder’s financial responsibility should be limited to the insurance deductible. If the cost of a new roof replacement is $10,000, $25,000, or even $100,000, the homeowner should only bear the financial cost of the deductible. Filing an insurance claim on large items such as a new roof or a hail damaged car makes sense, as the replacement cost or repairs will cost more than the deductible.

By contrast, filing an insurance claim for one damaged window by a hailstone will likely not be a wise investment. Even with an approved claim, the cost of replacement or repairs will likely be less than the deductible amount. For this reason, homeowners view the claim as denied.

PROOF POINT

In 2022, Metro City Roofing inspected a roof in Littleton, Colorado, with approximately 30 asphalt shingles lifted by the wind. His local insurance agent referred our company. We recommended minor roof repairs after our inspection but advised against filing a claim. The homeowner was initially surprised but, upon further explanation, understood that the cost of repairs would be less than his deductible.

So, while the insurance company may indeed find the same damage we documented, there would be no payment to cover the repairs.

Roof Insurance Claim Denied Due to Insufficient Coverage

Insurance companies establish coverage limits with each policy, protecting them to a maximum liability or amount they will pay for a covered peril like hail or wind. Knowing your coverage and limits should a natural disaster necessitate a claim when selecting an insurance policy is critical.

The first critical insurance coverage is called Replacement Cost Value (RCV), which means that you have full replacement coverage based on current market pricing. Lesser-priced policies are called Actual Cash Value (ACV), which reduce coverage based on age and condition. For example, an asphalt shingle roof that is fifteen years old will only cover 50% of the replacement cost since the roof is half its expected life. It is worth the additional insurance premium knowing you can replace what is damaged by hail or wind.

The second critical insurance coverage is called ordinance or law coverage, better known as code coverage. Why is this important? A reputable, licensed roofer will pull a permit with the local building department for every roof replacement. Building departments abide by building codes, which are updated regularly. Homeowners that include code coverage in their policy are covered if they replace their roof and must upgrade to meet the current code requirements.

Those who do not have this code coverage can pay hundreds to several thousand dollars of unplanned expenses. Examples of code requirements are Class 4 shingles, now required in the City of Fort Collins with every roof replacement or installation, drip edge, or solid decking. Manufacturers and local codes require installing roofs with a solid roof deck. Older homes may have several-inch gaps between boards that were OK when initially installed but no longer meet code. Commonly, rental homes do not have code coverage, but insurance companies allow this optional insurance as an upgrade. Unfortunately, many owners do not even know they lack this premium coverage.

The third critical insurance coverage is not choosing a roof exclusion policy. While saving a few dollars on your insurance may be appealing, it can save you thousands of dollars if your home gets damaged and needs a roof replacement.

PROOF POINT

As an experienced roofing company, we have seen it all concerning homeowners who selected the wrong policy that impacted their ability to file a claim and get their roofs approved.

In 2021, we inspected a roof in Broomfield, Colorado. We documented hail damage and discussed the insurance claims process. The homeowner shared that they have an ACV policy. We explained the difference in coverage, and the homeowner opted not to file a claim. Instead, she called her insurance company the next day, upgraded her policy, and now has Replacement Cost Value coverage.

Roof Insurance Claim Denied Due to Roof Age

Roofs have life expectancies based on their shingle type. Most 3-tab shingles have 25-year lifespans, and most architectural shingles have 30-year lifespans. Of course, this can vary based on the specific product selected.

Your roof may need to be replaced much sooner, depending on where you live. For example, in May 2017, a hailstorm passed through the Denver metro area, dropping hailstones as large as baseballs in Lakewood, Wheat Ridge, and Golden. Homeowners in these cities had extensive damage to their roofs and needed new roofs regardless of age. In 2016, one year earlier, we installed a new Class 4 shingles roof for a couple in Wheat Ridge. Class 4 shingles are the highest-rated shingles designed to withstand damage up to 2 inches in diameter. Sadly, less than one year later, following the extreme storm of 2017, this couple needed a new roof again.

On the other end of the spectrum, some homeowners are fortunate and enjoy their roofs for the entire intended lifespan. Most homeowners don’t think about their roofs unless there is a problem like a leak.

After the roof exceeds its life expectancy, it is unlikely that an insurance policy will cover any costs to repair or replace a roof.

A roof damage claim can be denied because of the roof’s age. Without significant storm damage on your roof, a homeowner will have difficulty getting his claim approved based on age or wear and tear. Adjusters must document and justify their position. Luckily, some may choose to confirm that the roof is not past its lifespan, which is excellent news for homeowners, but this is entirely up to the individual adjuster.

PROOF POINT

At Metro City Roofing, we have yet to experience this situation. While we know it undoubtedly exists, homeowners typically contact us to inspect their roofs following a hailstorm. And with the Colorado Front Range being known as “hail alley,” it is improbable that any home would avoid hail damage over 30 years.

Roof Insurance Claim Denied Due to Improper Roof Maintenance

As a homeowner, you are responsible for keeping your home in good working condition. A roof requires maintenance, including cleaning your gutters from debris.

Improper roof maintenance can be viewed as neglect and is one of the most common reasons insurance companies deny roof claims. Your insurance policy expects its policyholders to perform routine maintenance to keep the home and roof in good condition. If your adjuster and insurance company deem that you have not completed routine and expected maintenance over an extended time, it has reason to deny your claim.

For this reason, we recommend that all homeowners schedule regular roof inspections and complete minor roof repairs and maintenance, ensuring their roofs remain in good working condition. Regardless of coverage, catching a minor issue early can save thousands on much more expensive roof repairs or require a complete roof replacement.

PROOF POINT

We inspected a roof in Denver in 2018, where the homeowner admitted that she had never completed any roof maintenance or even cleaned her gutters in more than 30 years. She had not even thought about the roof since it was installed in the 1980s.

We explained that her claim would likely be denied if she shared this information with the insurance adjuster. The great news is that the roof had clear evidence of new hail damage. Since one of our company representatives was present during the adjuster meeting, we guided the process and successfully negotiated a roof replacement.

Roof Insurance Claim Denied Due to Not Owning the Home at the Time of Loss

Something that can surprise a homeowner when trying to file an insurance claim on their roof with hail damage or wind damage is that you must own the home at the date of loss to file a claim, or it will be denied. Today, many buyers are waiving home inspections. The new owner may have their roof inspected later and learn of hail damage and desire to file a claim. When they call their insurance company, they learn that they cannot file a claim if they do not own the home based on the most recent storm date.

Interestingly, as a homeowner, if you have changed insurance carriers, you can file a claim with your previous insurance company and get your claim approved.

PROOF POINT

Metro City Roofing inspected a roof in Boulder, Colorado, in December 2019. The homeowner contacted us due to various leaks inside the home from a significant snowstorm, where there were more than 12 inches of snow on the roof, slowly melting.

We identified gaps between the roofline and gutters when we inspected the roof. Without proper drip edge flashing, melting snow was dripping inside the home. The homeowner purchased the house on July 10, 2019, but unfortunately, the most recent storm date was July 5, 2019. Since he did not own the home at the date of loss, he could not file a claim on his new home.

An insurance company can or must deny your claim for many reasons. In some cases, clear policy language determines the denial. In other cases, the decision by an adjuster is subjective. You simply do not need to accept the initial decision in these situations.

Appealing a Homeowners Insurance Claim Denial

For many of the reasons listed above, policyholders have the right to appeal a homeowner insurance claim denial. If you disagree with the decision, the first action is to contact the insurance company and request a reinspection. Some insurance adjusters will even share this right during the initial inspection when homeowners express dissatisfaction.

Insurance companies may request that the insured or selected roofing contractor provide evidence of damages with photos, code documentation, receipts, or additional supporting evidence. To err is human, and the insurance company may learn that some damage was overlooked and change their position or agree to a reinspection. When the insurance company does not budge, we recommend contacting your local agent directly (if one exists) and asking them to advocate on your behalf. Local agents want satisfied customers and will frequently help when there is evidence of damage.

We recommend that our clients ask for an expected timeline for review and decision. Insurance companies can intentionally avoid providing this critical information. Based on the outcome of your request for reinspection, all hope is not lost.

Appealing insurance denied hail damage claim is your right as a policyholder.

You can ask to speak with the company’s supervisor or file a complaint with the regulatory agency in your state.

The next step for appealing a claim denial is hiring a licensed appraiser and submitting an Appraisal Demand Letter to the insurance company. This lets the insurance company know you are unwilling to accept their position. The insurance company has a timeline to acknowledge your dissatisfaction and name an independent appraiser to begin the appraisal process towards an aligned resolution.

The appraisal process can be time-consuming. Insurance companies intentionally drag out the process to dissuade contractors and homeowners over months. Insurance companies also use any tactic to deter homeowners, calling to share negative comments about the contractor or emailing with conflicting information to create confusion and question whether you should continue the process.

If the insurance company still pushes back, your selected appraiser may recommend hiring a lawyer specializing in insurance claims cases. This typically works to get the insurance company to proceed, but the lawyer may communicate to the insurance carrier that it will litigate in court based on established precedent.

How to Dispute a Roof Damage Insurance Claim Denial?

There’s no need to stress if your roof claim is denied—the following details how to dispute an insurance claim denial.

- Read your insurance policy carefully, focusing on the included and excluded covered perils in your policy. Call your insurance agent or company to explain further if you have any questions.

- Read your claim denial letter to understand the reason for the denial or the estimate to understand what gaps exist.

- Ask your roofing contractor to submit and share any documentation that supports the rationale for the claim to be approved. A quality roofer will typically do this on your behalf and happily include the homeowner in all communications.

- Call or email the adjuster directly. Focus on why you believe the position is incorrect and point the adjuster towards the documentation submitted to reconsider.

- Officially request a reinspection.

- Depending on the outcome, discuss the appraisal process with your selected roofer – and initiate the appraisal demand process.

While many insurance companies and adjusters will do what’s fair and objective when damage exists, that’s not always the case. And once you initiate the appraisal, the insurance company will often intentionally try to confuse facts with fiction. They count on the fact that most homeowners do not select the appraisal clause or follow it through. Any time this happens, they avoid paying out for your claim.

PROOF POINT

In late 2021, Metro City Roofing had a claim in Broomfield, Colorado, where a homeowner had his hail damage roof claim denied, not just once but twice.

The insurance company assigned a third-party adjuster from Hancock Claims Consultants to inspect the roof. One of our salespeople attended the inspection. The adjuster commented that if the homeowner had another insurance company (and mentioned the name of the company), then he would approve the claim, take 24 photos, and write up the estimate for a complete roof replacement. He made this same comment to the homeowner.

In this inspection report, the adjuster selectively excluded photos that displayed damage. The good news is that we photographed the adjuster marking hail damage on the roof and presented these photos to the insurance company, and explained the situation. The adjuster denied making his comments, but the homeowner confirmed the statement.

At Metro City Roofing, we now record all interactions with Hancock adjusters with video. They have earned the reputation as biased, executing precisely what the insurance company that hired them wants them to find. The adjusters always tell homeowners they really want to find damage to help get their claim approved but then deny it. So, we now video record them so they cannot lie.

How Your Local Roofing Company Can Help with Insurance Denied Hail Damage Roof Claim?

Not all roofing companies have the same experience with an insurance denied hail damage claim. The professionals at Metro City Roofing are insurance claims experts, working with all insurance companies and guiding our customers throughout the entire process. Our team has the necessary experience you can trust when your hail damage roof claim is denied. “What if Allstate denied my roof claim,” for example? We can help.

Our company has a 99% success rate in getting our customers’ claims approved when we recommend filing an insurance claim.

We start with a free roof inspection to determine whether your roof has damage from a recent storm and whether it qualifies for an insurance claim. Some roofing companies will hire just about anyone as a salesperson and provide insufficient training. Every year, roofing companies around the country hire college interns, recent graduates, and more for entry-level sales positions. They perhaps receive minimal training and are directed to begin knocking on doors in neighborhoods affected by hail. These people are not qualified to inspect your roof and lack experience working with insurance companies with any reasonable proven success.

- First, don’t trust a roofing contractor who knocks on your door.

- Two, when speaking with a local roofing contractor, ask your salesperson how long they’ve personally been in the industry, where they’ve worked, and their success rate.

- Three, ask for references from recent previous local customers and call them. Learn what others have experienced.

- And finally, ask about the company’s process when an insurance company denies your claim. Most roofers will offer to attend the insurance company inspection. But what happens when it does not go as expected? You want to know whether the company then moves on or continues to advocate for you.

Our roofing company has the experience to continue to support our customers and understands the claim denial process and requirements to switch the denial to acceptance for a complete roof replacement. Contact Metro City Roofing for your denied roof claim.

How Long Do You Have to Sue Over a Denied Insurance Claim?

Insurance companies establish clear policy timelines to file an insurance claim and complete all work. Most allow for one year, while State Farm allows its policyholders two years from the date of loss. If you have a denied insurance claim, you can continue to push the insurance company to overturn its decision, move to appraisal, and even sue long after this timeline. The key is not to give up at the first sign of denial. Don’t trust that the insurance company always has your best interest. It is a for-profit company that has a responsibility to its shareholders more than anything else. Your insurance denied roof claim might help the insurance company achieve its record profits.

Our company has recently informed a large insurance company of our intent to sue them for failure to accept the appraisal demand letter submitted. Our hired lawyer provided case precedent and a deadline to accept the appraisal, or we will see them in court.

How to Avoid Getting Your Roof Insurance Claim Denied?

You cannot control when storm damage affects your roof. When a hailstorm or windstorm unexpectedly damages your roof, you would expect that your homeowners insurance policy would cover all damages. It’s hard to imagine your roof insurance claim denied for a minor technicality or the subjectivity of an adjuster.

We recommend the following tips to avoid being in the situation where the insurance company to which you pay annual premiums denies your roof damage claim. Do your research, have the right insurance coverage, properly maintain your property, and file a claim timely if you must are the best methods to getting your claim approved vs. denied.

The following provides more detail about doing all you can to avoid getting your roof damage claim denied.

Research Insurance Companies Before Choosing One

Regardless of advertising campaigns and marketing, not all insurance companies have the same reputation for approving claims with fair market value payments. We highly recommend researching which company has earned the best reputation for coverage payments when storm damage occurs. Speak with friends and neighbors, search reviews for a local insurance agent on Google or the Better Business Bureau to better understand customer satisfaction.

Some insurance companies like Allstate, Safeco, and Liberty Mutual have recently switched to different estimating software that pays an average of 30% less than fair market value. Homeowners with these carriers are turning to the appraisal process simply to get paid enough to hire a roofing contractor to complete the roof repair or replacement scope of damages.

Further, research the different types of coverage, like Replacement Cost Value vs. Actual Cash Value, roof exclusion policy, code coverage, and whether you prefer a lower deductible with a higher premium or the opposite.

Know What Questions to Ask

Now that you’ve done some research, we recommend calling to speak with a live, experienced agent to discuss your objectives and coverage options. It’s best to have the agent create several options to suit your needs and budget.

We strongly recommend securing a policy with replacement cost value and code coverage.

Do not choose a roof exclusion policy to save a few dollars on your premium or get a policy that discounts payment for age and condition. For example, a homeowner with an Actual Cash Value policy with a 15-year-old roof will only get 50% of the current market replacement cost value – before insurance accounts for the deductible.

Study Your Insurance Policy

Once you’ve selected your homeowners policy, please read it, specifically the Declarations page, where it lists the details of your coverage. It’s essential to know your deductible before filing any claim, as this is the policyholder’s financial responsibility with any approved claim. Don’t get caught where you cannot afford to make the necessary roof repairs or replace your roof with a deductible you cannot afford.

Ensure that you’ve selected optional code coverage and the limits on such code-required upgrades. Most of the time, the code items do not exceed the limit, but it’s another critical area to know your coverage limits before being surprised with costs that exceed your expectations.

Maintain Your Roof Regularly

As professional roofers, we recommend that all homeowners have their roofs inspected annually and after any extreme storm like hail or strong winds. This way, homeowners can keep their roofs in optimal condition with regular maintenance.

Failure to maintain your roof properly is a top reason that your insurance company can deny your claim.

Keeping accurate records of all roof inspections and maintenance will demonstrate to your insurance company that you have made every effort to maintain your roof. With regular roof maintenance, an asphalt shingle roof can last between 20 to 30 years and minimizes most roof issues like roof leaks that could easily have been prevented by sealing exposed nails and exposed or loose flashings.

Don’t let your roof’s warranty provide a false sense of security against all issues for the entire roof’s lifespan. A roof warranty does not mean your roof will have no maintenance requirements over several decades. Homeowners should view a roof like other home maintenance requirements. Extreme storms can accelerate your roof’s useful life or cause specific damage depending on where you live.

File Your Roof Claim Timely

Remember that insurance companies establish strict limits by which policyholders can file a claim. It’s best not to wait to have your roof inspected following any storm to maximize the likelihood of getting your roof damage claim approved.

Many homeowners contact us once they see several neighbors having their roofs replaced or have numerous other roofing companies knocking on their doors offering free roof inspections. Regardless of the catalyst, we recommend calling a reputable roofing company timely and then filing your claim promptly once you’ve confirmed there is hail damage to your roof.

Do Not Give Up with a First-Time Denied Claim

All our sales and project management team members are licensed adjusters, carrying the same licensing credentials as insurance adjusters. Some roofs have clear evidence of extensive damage, while others have some less obvious damage.

Our insurance claim experts have learned over hundreds of roof claims that some are denied after the initial inspection.

Some claims require a reinspection to get your claim approved. The insurance company may require documentation such as photos, code documentation, or manufacturer installation requirements to get them to reconsider and support a second inspection.

There are some things homeowners can do to best position an insurance claim for success before a storm but do not give up with a denied claim. Insurance companies do not always have your best interest as they are for-profit companies. Beyond a reinspection, an appraisal is the next step policyholders have to challenge the claim denial. Challenging your insurance company with appraisal can be stressful and time-consuming. Insurance companies frequently intentionally delay the process, all with the intention that most homeowners give up, and the claim denial stands.

Get Your Roof Damage Insurance Claim Approved with a Knowledgeable Roofing Contractor in Denver and Nearby Areas

Our experts believe that knowledge is the best approach to avoid an insurance claim denial. Finding a reputable and trustworthy roofer is your best chance of getting your roof damage insurance claim approved. At Metro City Roofing, we are insurance claim experts with a 99% approval rate to get our customers roof claims approved when we recommend filing a claim.

Our team members guide our customers through the insurance claims process and handle everything on their behalf.

We are State Farm approved roofers and work with all insurance companies. Metro City Roofing is the local insurance agent’s top-recommended roofing contractor in the Denver metro area. Our company has the needed experience with the appraisal process. We continue to work to get your hail damage insurance claim approved, unlike other Denver roofing companies that recommend a claim and walk away at the first sign of denial.

Our company only does business in Colorado. We do not chase storms across the country. What that means for our customers is that we are licensed everywhere we complete a roof inspection and are well versed in local building codes to ensure we perform all roof replacements and roof repairs per the current code requirements.

As a policyholder, you are allowed to hire any roofing contractor. Don’t choose just any Denver roofing contractor. Choose Metro City Roofing, metro Denver’s most reputable roofing company. Our entire team works tirelessly for our leading reputation, one customer and one project at a time.

Why Choose Metro City Roofing?

Metro City Roofing is a Colorado roofing company, headquartered in Denver, CO. We specialize in hassle-free professional roofing and will treat your home like our own.

We deliver the best professional roofing services across the Denver metro area. We are proud of the excellent reputation we've earned, with outstanding customer satisfaction, one roof, and one customer at a time.

REQUEST FREE ROOF INSPECTION